Roth Ira Distribution Rules Secure Act

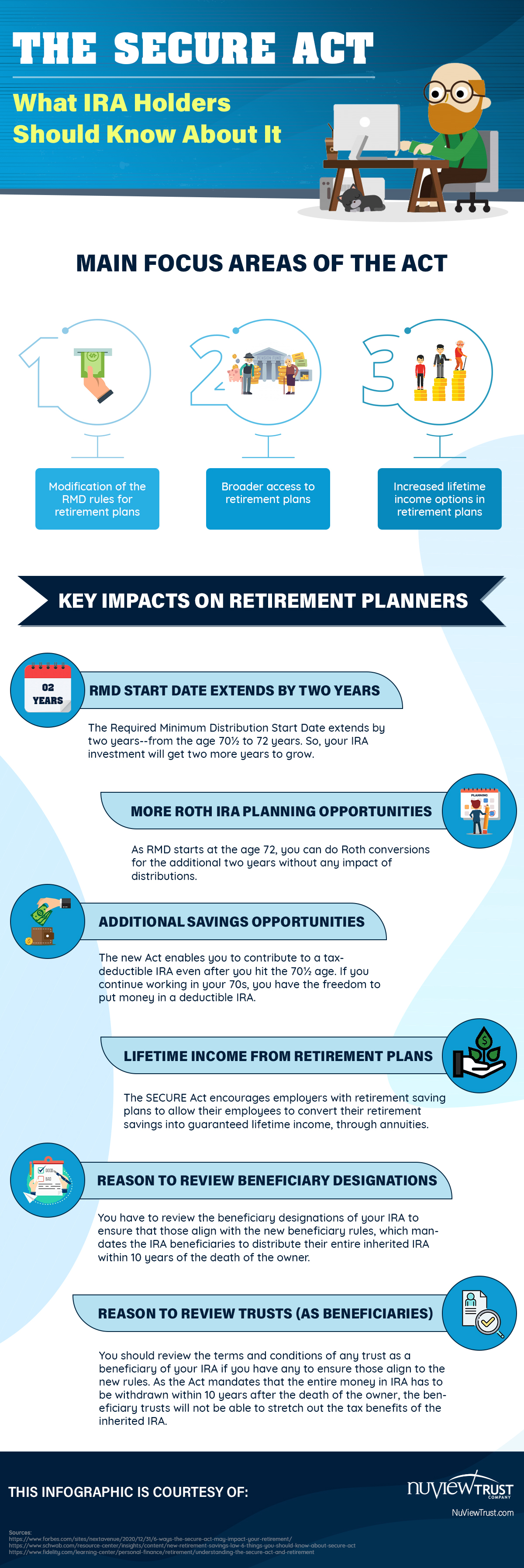

A provision of the secure act eliminates the ability of the beneficiary to take distributions over the life expectancy and replaces it with a 10 year rule.

Roth ira distribution rules secure act. The kids let the account sit for another ten years at which point they are. I considered the. When the second of this couple dies the money goes to their kids. The secure act took effect jan.

I generally support the ira changes in the secure act but there is a down side to the changing of the rules on inherited iras wrote rose young from north carolina. The top 10 ira provisions set forth below may impact any number of types of ira e g traditional roth inherited deemed simple and sep. The secure act consists of 29 provisions covering a variety of enhancements to qualified plan rules but perhaps even more importantly secure s new regs will make roth iras much more appealing. You can convert some of your ira to a roth ira a little at a time over several years so you can keep your income from creeping into a higher bracket.

The 10 year rule provides that.